Deal Sourcing: Generate Income Fast in Property

Deal sourcing is a great way to generate income in property quickly. This process involves finding a property deal, packaging it up, and selling it on to an investor for a fee. The best way to do this is to find a property that needs work, secure it at a discount, and sell it to an investor, or find an amazing high cash flow rent-to-rent deal and sell it on to an investor (typically £2,500k+ per deal).

Successful deal sourcing hinges on a keen understanding of the market, sharp negotiation skills, and a robust network of contacts. By leveraging these skills and connections, deal sourcers can identify undervalued properties, negotiate favorable purchase terms, and present these deals to investors who may lack the time or expertise to find such opportunities themselves.

One of the greatest benefits of deal sourcing is the potential for high returns with relatively low initial capital outlay. Instead of purchasing properties outright, deal sourcers earn income through finder's fees, which can be substantial depending on the deal's profitability. Additionally, this strategy provides an excellent way to build relationships with a network of investors, potentially leading to recurring business and long-term partnerships.

Moreover, deal sourcing offers significant flexibility. Whether you focus on residential properties, commercial real estate, or specialized markets like distressed properties or rental arbitrage, there are myriad opportunities to tailor your approach based on your expertise and market conditions. By consistently delivering valuable deals to investors, you can establish a reputation as a reliable source of high-quality investment opportunities.

The key benefits of deal sourcing include:

- Low Capital Requirements: Earn income from properties without needing to purchase them yourself.

- High Earning Potential: Command significant fees for sourcing and packaging lucrative property deals.

- Market Flexibility: Adapt your deal sourcing strategy to various property niches and market trends.

- Networking Opportunities: Build and maintain a strong network of investors and industry contacts.

- Skill Development: Enhance your market analysis, negotiation, and sales skills through continuous practice.

In conclusion, deal sourcing is a dynamic and profitable approach to property investment, providing numerous benefits and opportunities for those who master its intricacies. Whether you're a seasoned investor or new to the property market, incorporating deal sourcing into your strategy can lead to significant financial gains and professional growth.

Here's some juicy Rent to SA deals you could sell onto investors for £2,500 each

3 Bed House, R2SA, Liverpool, L36

£950/mo

31 views • 11 days ago

2 Bed House, R2SA, GL14

£895/mo

21 views • 18 days ago

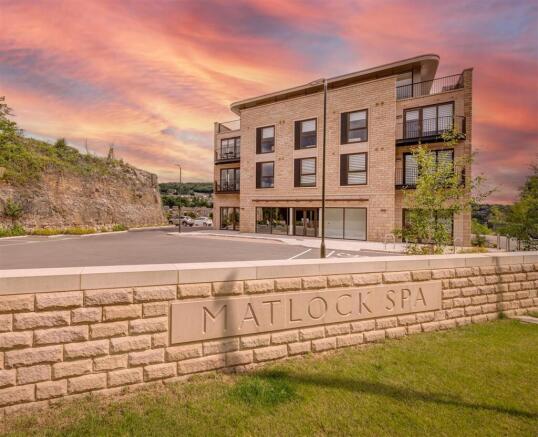

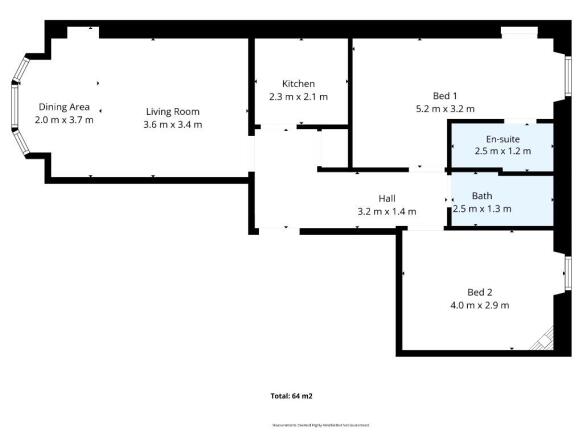

2 Bed Flat, R2SA, Matlock, DE4

£1,300/mo

11 views • 11 days ago

1 Bed Flat, R2SA, London, W1H

£2,383/mo

18 views • 5 days ago

2 Bed Flat, R2SA, Bath, BA1

£1,425/mo

13 views • 11 days ago

1 Bed Flat, R2SA, London, SW13

£1,995/mo

7 views • 14 days ago

2 Bed Flat, R2SA, Henley-on-Thames, RG9

£1,550/mo

8 views • 3 days ago

1 Bed Flat, R2SA, Henley-on-Thames, RG9

£1,550/mo

3 views • 11 days ago

1 Bed Flat, R2SA, Henley-on-Thames, RG9

£1,550/mo

2 views • 10 days ago

1 Bed House, R2SA, Edinburgh, EH16

£975/mo

6 views • 10 days ago

4 Bed House, R2SA, Livingston, EH53

£2,000/mo

8 views • 18 days ago

1 Bed Flat, R2SA, London, SW6

£2,000/mo

2 views • a month ago

Watch how to find Rent to SA deals on Dealsourcr instantly 👇

Dealsourcr is loved by investors & deal sourcers nationwide

Don't just take our word for it.

Software That Sells Itself

“Every property investor I meet is shown Dealsourcr's power and time-saving features. The software is self-promoting once its capabilities are demonstrated.”

Effortless Deal Finding

“Get rich in property by working hard or use dealsourcr.com for effortless deal evaluation. It's a smart way to identify lucrative investments quickly.”

Time-Saving Site

“Dealsourcr has been a fantastic find, saving me hours on Rightmove. Its continuous improvements make it an invaluable tool for property searches.”

Quick & Efficient Tool

“Dealsourcr.com is an incredible time-saver for property investors. It's made my deal analysis and Rightmove searches quick and headache-free. A must-use resource!”

Innovative Sourcing Platform

“Dealsourcr.com is an innovative tool for easier property sourcing. It's been a wise investment with great ROI, simplifying the investment process.”

Game-Changing Experience

“Using dealsourcr.com for 4 weeks has transformed my approach to deals. It simplifies the entire process - finding, stacking, and selling deals. It's a must-visit site for deal seekers.”

Quick List Building

“The negative equity engine on dealsourcr.com enabled me to compile a list of 250 properties in just an hour, a task that previously took a week.”

Valuable Investment Platform

“Dealsourcr.com has brought immense value to our property investment. It aids in efficient deal analysis, helping us find high-yield properties quickly.”

Frequently Asked Questions

Answers to common questions about Dealsourcr.